Digital transformation is reshaping industries and redefining daily operations across the board.

Rama Kadapala, a Senior Data Science Manager at Discover

Digital transformation is reshaping industries and redefining daily operations across the board. Technology is percolating into India’s day to day life and companies are forced to adopt and evolve alongside. Given the dynamic landscape, financial institutions are rethinking how they engage with customers, particularly in collections and hardship assistance.

As economic uncertainties persist, the ability to leverage data-driven strategies, automation, and AI to enhance customer support is more critical than ever. Rama Kadapala, a Senior Data Science Manager at Discover, has been at the forefront of this transformation. A seasoned expert in data science and analytics, Kadapala emerged as a key figure in turning data into a force for good. With over a decade of experience at global institutions like Discover, HSBC, and CURO Financial Technologies, Kadapala specializes in designing and implementing data-driven financial programs that balance the needs of banks with the people that rely on them.

"There's a misconception that data is cold and impersonal," he explains.

"The right data enables support at a scale that's impossible to achieve in any other way. It helps you see the full picture—everyone at once". Kadapala has pioneered innovative collections strategies that integrate machine learning, omnichannel engagement and regulatory compliance to create a more empathetic and effective approach to customer assistance.

“The traditional collections model is evolving,” says Kadapala, recipient of the ‘Best Risk Management & Investment Presentation’ award at ICMR 2024.

“AI and data-driven insights are helping us to look beyond rigid payment plans, allowing for greater flexibility and personalized solutions that are far more humane. These innovations help our customers regain financial stability and get back on their feet.”

Rama has been a tech-warrior to come up with smart solutions that have customer centricity at its heart. He actively contributes to the industry’s evolution by presenting groundbreaking research and sharing insights at top-tier conferences, driving innovation and collaboration. At the 2024 IEEE International Conference on Augmented Reality, Intelligent Systems, and Industrial Automation (ARIIA-2024), he was invited to serve the advisory board and as a session chair, playing a key role in shaping discussions on emerging advancements in Robotics, Industry 4.0 & 5.0, Bioengineering, Artificial Intelligence, Machine Learning and related fields.

Speaking about the evolution of collection strategy through technology, Rama explained, “Collections used to be a rigid process—calls, letters, and escalating penalties. Some companies resorted to humiliation and muscle power to little or no consequences. The shift towards digital-first banking has opened up opportunities for real-time engagement, predictive analytics, and customer-centric hardship solutions. “ Kadapala’s work in developing AI-powered segmentation models has changed how institutions approach collections and have helped financial institutions reduce charge-offs by nearly 100 million dollars while improving customer retention.

He explained,” With this technology in place, financial institutions can predict financial distress early on and tailor solutions accordingly. You need to push a door for it to open – if you keep pushing a wall there will be no result”.

Meet 'Purushon Ka Rashmika Mandanna', actor who achieved stardom after 20 years of struggle, now gives back to back hits, he is...

Meet 'Purushon Ka Rashmika Mandanna', actor who achieved stardom after 20 years of struggle, now gives back to back hits, he is... SRH vs PBKS, IPL 2025: Abhishek Sharma smashes record-breaking 141 as Sunrisers Hyderabad beat Punjab Kings by 8 wickets

SRH vs PBKS, IPL 2025: Abhishek Sharma smashes record-breaking 141 as Sunrisers Hyderabad beat Punjab Kings by 8 wickets SRH vs PBKS: Abhishek Sharma pulls out unique celebration after blasting 40-ball IPL century

SRH vs PBKS: Abhishek Sharma pulls out unique celebration after blasting 40-ball IPL century 'Hype thi, par khoda pahaad nikli chuhiya': Navjot Sidhu roasts MS Dhoni's captaincy return during CSK vs KKR IPL 2025 match

'Hype thi, par khoda pahaad nikli chuhiya': Navjot Sidhu roasts MS Dhoni's captaincy return during CSK vs KKR IPL 2025 match Jaat box office collection day 3: Sunny Deol-starrer jump on Saturday, earns Rs 32 crore worldwide

Jaat box office collection day 3: Sunny Deol-starrer jump on Saturday, earns Rs 32 crore worldwide SRH vs PBKS Highlights: Travishek के तूफान में उड़ा पंजाब, हैदराबाद की ऐतिहासिक जीत; पंजाब को 8 विकेट से दी शिकस्त

SRH vs PBKS Highlights: Travishek के तूफान में उड़ा पंजाब, हैदराबाद की ऐतिहासिक जीत; पंजाब को 8 विकेट से दी शिकस्त Supreme Court का ऐतिहासिक फैसला, पहली बार तय की राष्ट्रपति के लिए डेडलाइन, 5 पॉइंट्स में जानें सबकुछ

Supreme Court का ऐतिहासिक फैसला, पहली बार तय की राष्ट्रपति के लिए डेडलाइन, 5 पॉइंट्स में जानें सबकुछ कौन हैं Chanchal Mata, बॉलीवुड एक्ट्रेस जैसी खूबसूरत है ये अघोरी साध्वी, खाली हाथों से लगा देती हैं हवन में आग

कौन हैं Chanchal Mata, बॉलीवुड एक्ट्रेस जैसी खूबसूरत है ये अघोरी साध्वी, खाली हाथों से लगा देती हैं हवन में आग UP के चीफ सेक्रेटरी और DGP से ज्यादा अमीर हैं DM और SP, जानिए कौन उत्तर प्रदेश का सबसे अमीर अधिकारी?

UP के चीफ सेक्रेटरी और DGP से ज्यादा अमीर हैं DM और SP, जानिए कौन उत्तर प्रदेश का सबसे अमीर अधिकारी? जानें कौन हैं अलीगढ़ के VVIP दूल्हा-दुल्हन? जिनकी शादी में आशीर्वाद देने पहुंचे सपा प्रमुख अखिलेश यादव

जानें कौन हैं अलीगढ़ के VVIP दूल्हा-दुल्हन? जिनकी शादी में आशीर्वाद देने पहुंचे सपा प्रमुख अखिलेश यादव SRH vs PBKS, IPL 2025: Abhishek Sharma smashes record-breaking 141 as Sunrisers Hyderabad beat Punjab Kings by 8 wickets

SRH vs PBKS, IPL 2025: Abhishek Sharma smashes record-breaking 141 as Sunrisers Hyderabad beat Punjab Kings by 8 wickets SRH vs PBKS: Abhishek Sharma pulls out unique celebration after blasting 40-ball IPL century

SRH vs PBKS: Abhishek Sharma pulls out unique celebration after blasting 40-ball IPL century 'Hype thi, par khoda pahaad nikli chuhiya': Navjot Sidhu roasts MS Dhoni's captaincy return during CSK vs KKR IPL 2025 match

'Hype thi, par khoda pahaad nikli chuhiya': Navjot Sidhu roasts MS Dhoni's captaincy return during CSK vs KKR IPL 2025 match SRH vs PBKS: Marcus Stoinis dominates Mohammed Shami, hits four sixes in last over as Indian pacer records second-most expensive IPL 2025 spell

SRH vs PBKS: Marcus Stoinis dominates Mohammed Shami, hits four sixes in last over as Indian pacer records second-most expensive IPL 2025 spell Watch: Virat Kohli meets Rahul Dravid and hugs him in heartfelt reunion before RR vs RCB IPL 2025 clash

Watch: Virat Kohli meets Rahul Dravid and hugs him in heartfelt reunion before RR vs RCB IPL 2025 clash Delhi Rain: Thunderstorms And Rain Bring Long-Awaited Relief To NCR After Days Of Scorching Heat

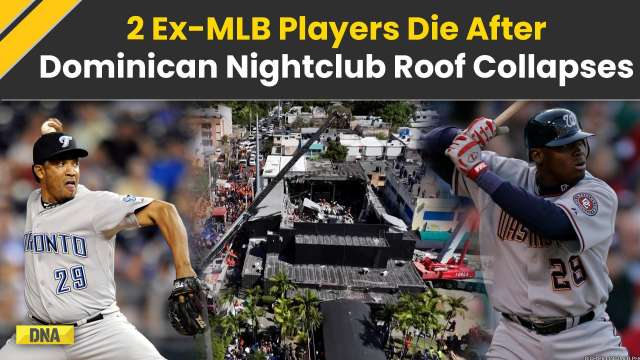

Delhi Rain: Thunderstorms And Rain Bring Long-Awaited Relief To NCR After Days Of Scorching Heat Dominican Republic Nightclub Collapse: Former MLB Players Octavio Dotel & Tony Blanco Among Deceased

Dominican Republic Nightclub Collapse: Former MLB Players Octavio Dotel & Tony Blanco Among Deceased Trump Tariffs: How Much Money Will the US Make From Tariffs? President Donald Trump Reveals

Trump Tariffs: How Much Money Will the US Make From Tariffs? President Donald Trump Reveals Trump Tariffs: US Slaps 104% Tariff On China After Beijing Misses President Trump's Deadline

Trump Tariffs: US Slaps 104% Tariff On China After Beijing Misses President Trump's Deadline Pawan Kalyan Shares Son Mark Shankar’s Health Update Injured In Singapore School Fire Incident

Pawan Kalyan Shares Son Mark Shankar’s Health Update Injured In Singapore School Fire Incident Meet Delhi billionaire, started company as bottler, became liquor baron with brands like Magic Moments, 8PM Whisky; his net worth is Rs...

Meet Delhi billionaire, started company as bottler, became liquor baron with brands like Magic Moments, 8PM Whisky; his net worth is Rs... Meet man, sole billionaire of Nepal, known as 'Noodle King,' has THIS connection to India

Meet man, sole billionaire of Nepal, known as 'Noodle King,' has THIS connection to India Meet the owner of Rosy Blue, one of world's top diamond companies, close relative of Mukesh Ambani, Nita Ambani, Anant Ambani, Akash Ambani

Meet the owner of Rosy Blue, one of world's top diamond companies, close relative of Mukesh Ambani, Nita Ambani, Anant Ambani, Akash Ambani Mukesh Ambani's Reliance Industries increases stakes in shipbuilding industry, invests in THIS company

Mukesh Ambani's Reliance Industries increases stakes in shipbuilding industry, invests in THIS company When Mukesh Ambani declared who is his boss in real life, hint it's another Ambani but not Nita Ambani, Anant Ambani, Akash Ambani

When Mukesh Ambani declared who is his boss in real life, hint it's another Ambani but not Nita Ambani, Anant Ambani, Akash Ambani Meet Celebrity MasterChef winner Gaurav Khanna's wife Akanksha Chamola

Meet Celebrity MasterChef winner Gaurav Khanna's wife Akanksha Chamola Is Wamiqa Gabbi the new Preity Zinta: Bubbly actress set for Bhool Chuk Maaf release

Is Wamiqa Gabbi the new Preity Zinta: Bubbly actress set for Bhool Chuk Maaf release In pics: Meet Lalita Dsilva, childhood nanny of Anant Ambani, Taimur and Jeh Baba, she is also a pediatric nurse

In pics: Meet Lalita Dsilva, childhood nanny of Anant Ambani, Taimur and Jeh Baba, she is also a pediatric nurse Meet Chef Vikas Khanna, Harvard University's Person of the Year

Meet Chef Vikas Khanna, Harvard University's Person of the Year  Sachin Tendulkar's daughter Sara Tendulkar holds a Master's degree in...from...

Sachin Tendulkar's daughter Sara Tendulkar holds a Master's degree in...from... 88-year-old wife accuses 91-year-old husband of extra-marital affairs, then THIS happened...

88-year-old wife accuses 91-year-old husband of extra-marital affairs, then THIS happened... What is controversy over statue of DOG near memorial of Shivaji Maharaj at Raigad Fort?

What is controversy over statue of DOG near memorial of Shivaji Maharaj at Raigad Fort?  Did West Bengal CM Mamata Banerjee protect, encourage anti-Hindu violence? This is what BJP said

Did West Bengal CM Mamata Banerjee protect, encourage anti-Hindu violence? This is what BJP said Inside luxurious business jet Gulfstream, that brought 26/11 Mumbai attack plotter Tahawwur Rana to India

Inside luxurious business jet Gulfstream, that brought 26/11 Mumbai attack plotter Tahawwur Rana to India Delhi CM Rekha Gupta sees man throw 'roti' at cow on busy road, approaches him and does this

Delhi CM Rekha Gupta sees man throw 'roti' at cow on busy road, approaches him and does this Meet man who used to sleep with beggars, failed class 12, cracked UPSC with AIR....

Meet man who used to sleep with beggars, failed class 12, cracked UPSC with AIR.... Meet man who secured placement package of whopping Rs 1.03 crore per annum, not from IIT, IIM, NIT; he is from...

Meet man who secured placement package of whopping Rs 1.03 crore per annum, not from IIT, IIM, NIT; he is from... Meet man who scored 100 percentile in JEE Mains with rank 14, then cleared JEE Advanced with rank 2, later went to Berkeley for…

Meet man who scored 100 percentile in JEE Mains with rank 14, then cleared JEE Advanced with rank 2, later went to Berkeley for… Meet woman who studied Economics in London, cleared UPSC exam on 3rd attempt, later married another IAS officer, her AIR was...

Meet woman who studied Economics in London, cleared UPSC exam on 3rd attempt, later married another IAS officer, her AIR was... Meet woman who used her father-in-law's idea to build spice empire after her husband lost his job, now has hundreds of...

Meet woman who used her father-in-law's idea to build spice empire after her husband lost his job, now has hundreds of...

)

)

)

)

)

)

)

)

)

)

)

)